Written by: Aleksandar Ristovski, Head of Electricity Market Management DepartmentNational Electricity Market...

Written by: Nikola Stojanov, Analyst

The average price per megawatt-hour on our electricity exchange for the first nine months of this year is competitive with the prices achieved on the larger exchanges operating in Hungary and Greece. Even though those exchanges have been active for many more years, have higher liquidity, and operate within larger power systems, the price differences between them and our power exchange are minimal. In fact, in March of this year, we even recorded the lowest average monthly price compared to the two larger exchanges. Better days lie ahead for MEMO, our power exchange operator.

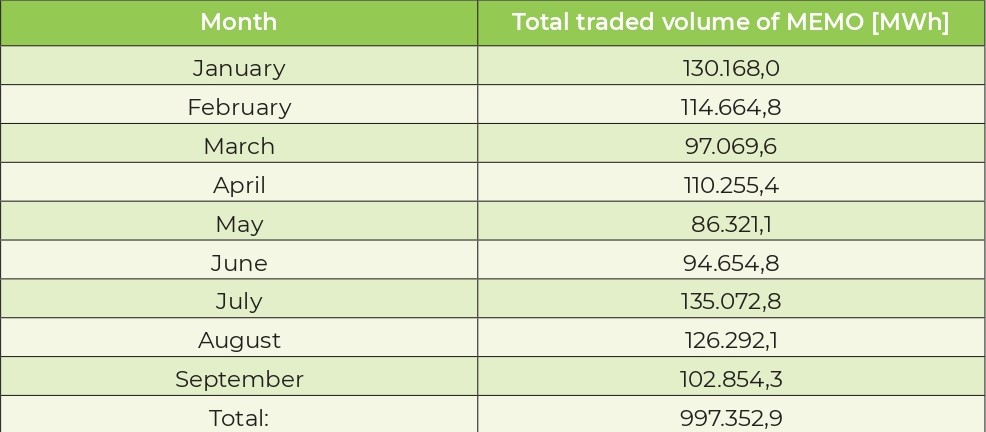

This is because, in the near or foreseeable future, our power exchange will be able to absorb at least part of the significant transit potential of the Macedonian electricity transmission system, which will happen once the first coupling with one of the neighbouring power exchanges is achieved. In the first nine months of this year, 997,350 megawatt-hours of electricity were traded on the Macedonian power exchange, according to official and publicly available data. During this period, the power exchange recorded a turnover of more than 100 million euros, money received by the market participants who sold the electricity and paid by those who bought or consumed it.

The results achieved by the power exchange, from May 2023 until now, based on the day-ahead trading model, and by MEMO, the state-owned company operating the organized electricity market, are worthy of recognition for several reasons. First, our power exchange is relevant. This can be concluded by comparing the amount of electricity traded on the exchange with the total electricity that, according to MEPSO data, was taken (i.e., consumed) by large (direct) consumers and by suppliers through the electricity distribution systems.

Namely, this comparison shows that in the first eight months of this year, the electricity traded on the exchange accounted for more than 26 percent of the total electricity taken from the distribution systems and by direct consumers. This represents a significant share of domestic electricity consumption and is clear evidence that consumers and suppliers already recognize our power exchange as relevant and actively trade on it.

Second, from the fact that nearly one million megawatt-hours of electricity worth more than 100 million euros were traded through the exchange, it can be concluded that the participants in the organized electricity market trust MEMO and the power exchange. This can be seen by the fact that they entrusted almost one million megawatt-hours of electricity to this trading platform and paid or collected over 100 million euros through it in the period January–September of this year.

It is clear that during these slightly more than 2.5 years of operating the exchange, MEMO has proven to be a reliable partner for all 38 companies participating in the exchange. Participants built this business trust on the following bases: participants know that, as sellers, they will collect payment for the electricity sold within the agreed timeframe, or, as buyers, they will reliably receive the electricity during the period for which they paid.

Third, the key and strategically important newly created value is the transformation from a planned to a market-based electricity system! This is the newly created value of the reform, i.e., a relevant price based on objective supply and demand for electricity for each hour of the day. Since May 2023, North Macedonia has its own market-based electricity price determined by real supply and demand. This price signal is important for all future investments in the energy sector, as well as in other areas where the electricity price serves as a critical input or indicator for creating business plans. A comparison of electricity prices achieved on our power exchange with those on the Hungarian (HUPX) and Greek (ENEX) power exchanges does not show significant differences. The comparison indicates that the differences are only in nuances. However, the advantage is on our side because our exchange is the youngest, and although our market is the smallest compared to the other two national electricity systems, it has great growth potential. HUPX and ENEX have been operating for a longer time, serve larger electricity markets, have higher liquidity than our exchange, and are connected (coupled) with the power exchanges of neighboring countries.

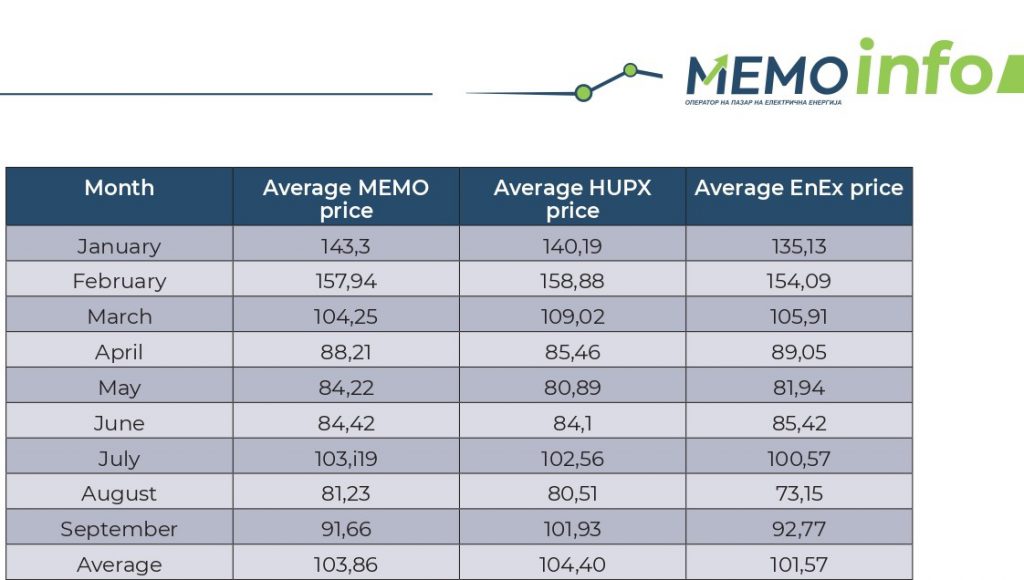

Regional Price Comparison for the Period 01.01.2025-30.09.2025

The price comparison was made between the Macedonian power exchange (MEMO), the Hungarian power exchange (HUPX), and the Greek power exchange (EnEx).

The comparison of price data from January to September for the three exchanges shows that our exchange is competitive, and in March, it even recorded the lowest average price compared to the other two exchanges. It is also worth pointing out that the average price of our exchange for the first nine months is lower than the price of HUPX.

When comparing the prices of these exchanges, it must be taken into account that purchasing electricity from a foreign market also involves the cost of cross-border transmission capacity, as well as other transaction costs, trading fees, and charges for trading on any of the compared exchanges.

The optimism for the future of the MEMO power exchange is objective because the Macedonian electricity transmission system has significant potential as a transit hub. And this should especially come to the fore and be valorised through couplings with the neighbouring transmission systems in the near future.

MEMO Info